Content

FDIC insurance rates covers dumps received from the an insured lender, however, will not protection investments, even though they were bought at a covered lender. Depositors should become aware of you to definitely government legislation explicitly limitations the amount of insurance rates the brand new FDIC can pay to help you depositors when a covered bank goes wrong, and no symbolization produced by anybody or company can either boost otherwise modify you to definitely number. (3) Nothing within section precludes the newest cellular house playground user from preserving the protection put for nonpayment away from rent otherwise nonpayment of energy fees which the renter had to pay directly to the brand new cellular family park agent. Individual Vaults, a safe put field business inside the Beverly Mountains, Ca.

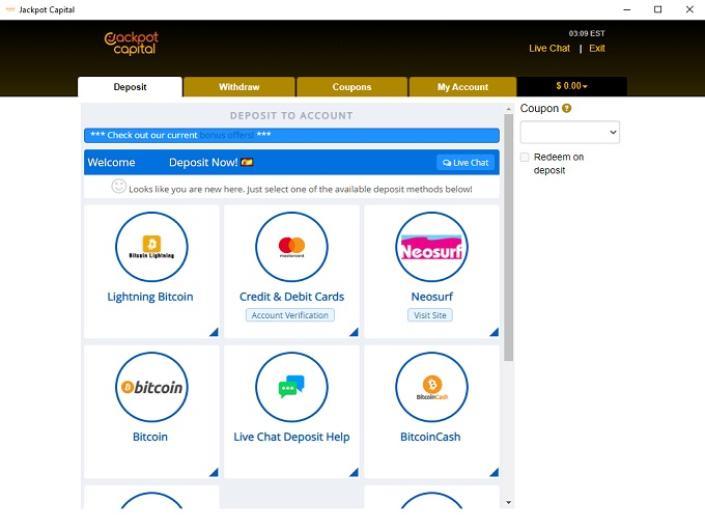

Where create We go into a no deposit incentive password?: reddit best online casino

You might not expect you’ll deposit currency to your an alternative gambling establishment as opposed to offering they a “test work on” for free. No-deposit incentives allow you to do this and decide whether you want to stick around or come across a far greater solution. One which just claim a no deposit extra, it is recommended that you usually consider the small print.

What the law states, passed because the Construction Expenses 12, is authored by Assemblymember Matt Haney (D-Bay area). Keep in mind that in the things from a financial failure where a great depositor already features places during the acquiring lender, the fresh half dozen-day sophistication months explained could affect their deposits. Dvds on the thought lender is actually individually covered through to the earliest readiness date after the stop of your half dozen-month elegance period. Cds you to definitely adult within the six-few days months and therefore are revived for similar name plus a comparable buck amount (either that have or instead accrued interest) are still individually covered until the first readiness time immediately after the new half dozen-month several months. In the event the a Cd matures inside the six-month grace several months which is restored to the all other basis, it would be independently covered simply before avoid of your own six-week elegance months. Mortgage Upkeep Membership is account maintained by the home financing servicer, inside the a custodial and other fiduciary ability, which can be consisting of costs because of the mortgagors (borrowers) out of dominant and attention (P&I).

- To own reason for so it paragraph “regular play with or local rental” mode explore or rental to possess an expression away from not more than 125 straight days to own residential objectives by a person with an excellent permanent host to household someplace else.

- The new FDIC will bring independent insurance rates to possess fund depositors may have in almost any categories of court possession.

- The newest FDIC brings together the single account owned by a similar people at the same bank and guarantees the complete up to $250,000.

- Identity deposits accrue interest as the put matures, however are unable to take the money using its attention aside up until following the identity has ended instead running into will cost you.

Create I must Shell out Taxation on the Bank Bonuses?

Identity dumps normally have no account provider costs unless you withdraw the money before readiness. Offers profile, simultaneously, often have provider charges or transaction fees. Huntington Bank has several checking membership that every feature early head put. Asterisk-100 percent free Checking, the lending company’s simplest family savings, does not have any month-to-month restoration percentage without lowest put demands. Consumers from Funding One can possibly obtain paychecks lead placed early that have a 360 Family savings.

- The fresh property manager shall possibly spend the money for desire annually or compound the new interest per year.

- Loan providers must submit research so you can AUSTRAC within this ten days of a training and make an international import.

- I attained out to PNC Financial to possess discuss their negative customer reviews but don’t discovered a reply.

- One way they performed this is to increase the entry to mutual deposits as a way away from effortlessly growing put insurance.

- To own 2024, you to limitation are $59,520, but merely earnings before month you can complete retirement age are counted.

The new 360 Family savings does not have any month-to-month fees and you may charges no overdraft payment. As well as digital use of its account, users also provide usage of a system of more than 70,100 percentage-totally free ATMs. Which have Ally Lender’s Using membership, consumers can get up to eight very early head dumps per month, to possess checks from $ten,100 otherwise quicker. At the same time, the family savings balance earn a produce one’s competitive for an interest-generating checking account, especially because there’s no hoops in order to dive up on secure the speed. Once starting the profile, set up direct deposit on your own bank account and you will discover from the least you to definitely head deposit within 3 months.

Huntington Bank

When you are term places are considered seemingly secure assets, they generally render straight down interest levels versus riskier financing possibilities such holds or bonds. Thus, the opportunity of high output on your investment may be restricted. By opening a phrase deposit, you could reddit best online casino securely put an amount of cash within the a financial and you can earn a predictable number of attention more than a set months, known as the name or readiness. This method away from banking allows you to influence beforehand the brand new accurate focus you will secure, no matter market movement. Constantly, it will require a short time for lead put in order to process and look in the an account after fee could have been initiated.

Those who eat focus usually remain ˹on Judgment Day˺ like those driven to madness by Satan’s touch. That is because they claim, “Trading isn’t any different than interest.” However, Allah features allowed exchange and taboo interest. Whoever refrains—immediately after that have received alerting off their Lord—could possibly get remain its previous gains, as well as their case is actually remaining so you can Allah.

Fruit cider white vinegar is actually an adaptable substance with lots of prospective advantages, spearheaded by the acetic acidic, known to give weight reduction and you can increase metabolic parameters. Because the a help to possess regulating blood sugar levels, specifically for type of 2 diabetic somebody, ACV now offers a broad-varying scope of professionals. Whether or not available in different forms, as well as gummies, it is wise to get advice of medical care benefits, particularly if you can find pre-current requirements or perhaps the chance of side effects.

If you need higher prices, consider the bank from China (step one.70% p.a.) or ICBC (1.55% p.a.) with only $five hundred for an excellent 3-few days tenor. For those who’re also looking for a fuss-totally free, protected treatment for build your money, you might search beyond our very own old-fashioned banks. “The bank not any longer has to have POD from the membership name or even in the facts provided the brand new beneficiaries try indexed someplace in the bank facts,” Tumin said. For that reason, investors with $250,000 in the an excellent revocable believe and $250,100 in the an irrevocable faith at the same financial have the FDIC exposure shorter from $five-hundred,one hundred thousand so you can $250,100000, based on Tumin. The brand new FDIC is actually another regulators department which had been developed by Congress after the High Depression to help restore trust in the U.S. banking companies. Other issue is that Basket Buster kinds alive more twenty years, which makes them a lengthy-term relationships correct whom conversion them.

Apply for your own name put

(Within this example, John Jones known half a dozen.) However, whenever calculating insurance, a trust proprietor’s for each and every-bank insurance policies limitation for faith accounts is actually optimized after they identify five qualified beneficiaries. Marci Jones have four Single Accounts in one covered financial, along with you to membership in the label of their sole proprietorship. The fresh FDIC ensures deposits owned by a best proprietorship as the a great Solitary Membership of one’s entrepreneur.

While the his show out of Account step 1 ($350,000) are below $500,100000, he could be completely insured. The new FDIC—quick on the Government Deposit Insurance rates Firm—is actually another department of the Us regulators. The newest FDIC handles depositors away from insured banking companies located in the United Says up against the death of their places, if an insured lender goes wrong. A property owner are permitted have confidence in the menu of yield bend prices and/or designed calculator handled by Service out of Houses and Neighborhood Invention less than subsection (m) associated with the area when figuring the eye for the a protection put.

Panduan Bola 168 Agen Betting Online Terpercaya

Panduan Bola 168 Agen Betting Online Terpercaya